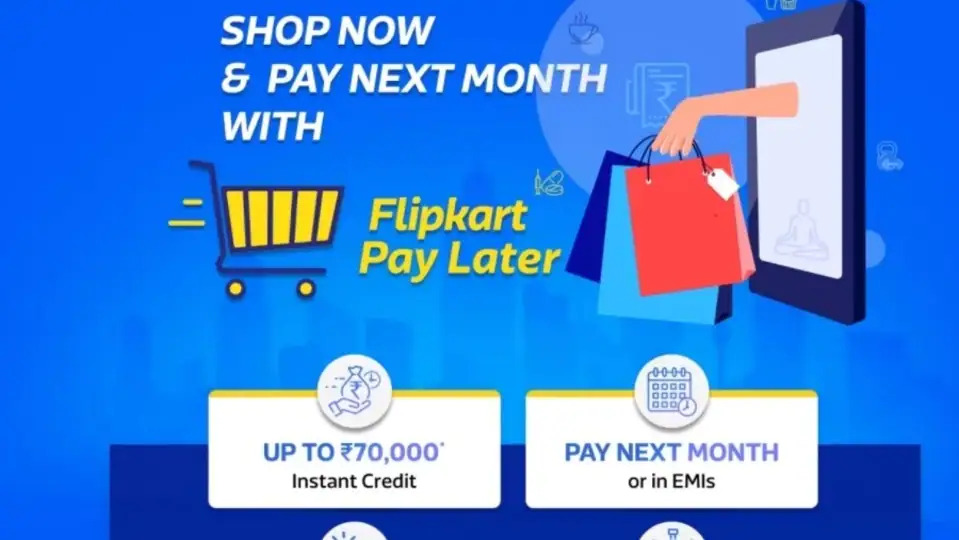

Online shopping has become an integral part of our lives, offering unparalleled convenience and access to a vast array of products. With the rise of e-commerce giants like Flipkart, shopping for everything from electronics to fashion has never been easier. To make the shopping experience even more convenient, Flipkart introduced a game-changer – Flipkart Pay Later.

What Is Flipkart Pay Later?

Flipkart Pay Later is a digital payment method that allows you to shop on Flipkart without the need for immediate payment. It’s essentially a credit offering from Flipkart, but with some unique twists. Here’s how it works:

- Shop Now, Pay Later: When you choose Flipkart Pay Later as your payment option, you can complete your purchase without entering your credit card details or making an immediate payment.

- Interest-Free Period: You get a grace period of up to 40 days to settle your dues. This means you can enjoy your purchases without worrying about immediate payments.

- Monthly Billing: At the end of each billing cycle, you’ll receive a statement detailing your purchases and the due date for payment.

- No Extra Charges: Flipkart Pay Later is interest-free if you make the payment within the stipulated time frame. This means no additional charges or interest will be levied.

- Quick and Easy: The signup process for Flipkart Pay Later is straightforward, and approval is usually swift, making it accessible to many shoppers.

Benefits of Flipkart Pay Later

1. Shopping Flexibility

Flipkart Pay Later provides you with the flexibility to shop for your favorite products without worrying about immediate payments. This is especially useful during sales events or when you come across irresistible deals.

2. Interest-Free Period

The interest-free period of up to 40 days allows you to space out your expenses and manage your finances better. You can make purchases early in the billing cycle and have ample time to pay later.

3. Secure Transactions

Flipkart ensures secure transactions when you use Pay Later. Your financial information is safeguarded, giving you peace of mind while shopping online.

4. No Additional Charges

As long as you clear your dues within the specified time frame, you won’t incur any extra charges or interest. This feature sets Flipkart Pay Later apart from traditional credit options.

5. Simplified Billing

You’ll receive a clear and concise statement at the end of each billing cycle, making it easy to track your spending and manage your payments.

How to Get Started

Getting started with Flipkart Pay Later is a breeze. Here’s a step-by-step guide to help you:

- Create a Flipkart Account: If you don’t already have one, sign up for a Flipkart account.

- Check Eligibility: Verify if you’re eligible for Flipkart Pay Later. This information is typically available during the checkout process.

- Select Pay Later: During checkout, choose Flipkart Pay Later as your payment option.

- Complete the KYC: If required, complete the Know Your Customer (KYC) process to activate your Flipkart Pay Later account.

- Enjoy Shopping: Once your Pay Later account is activated, you can start shopping immediately.

Very helpful article